For at least two decades, the theme of the link between automation and labour productivity has dominated much of the debate amongst economists - not just Marxists. We have approached this theme before.1 This contribution will stress the fact that productivity gains are an essential factor in the dynamics of capital and outline some thoughts concerning the period opened up by the pandemic.

The key role of productivity

During the crisis company profitability fell sharply. Let us start from the - probable - principle according to which their major concern will be to restore this profitability as soon as possible. What factors can they play on? Globally, the euthanasia of “zombie companies” would reduce the amount of capital to be valorised. Order givers will be able to put - even more - pressure on subcontractors or try to relocate an additional part of their activities. Freezing wages is obviously a way to cut costs, especially if part of this drop is covered by the state, which can also - as is already done in France - reduce corporate taxes.

One key variable remains: labour productivity. This measures the volume of goods or services produced per employee (productivity per head) or per hour of work (hourly productivity). Between these, there is labour time: if we can lengthen it, as the employers suggest, we increase per capita productivity.

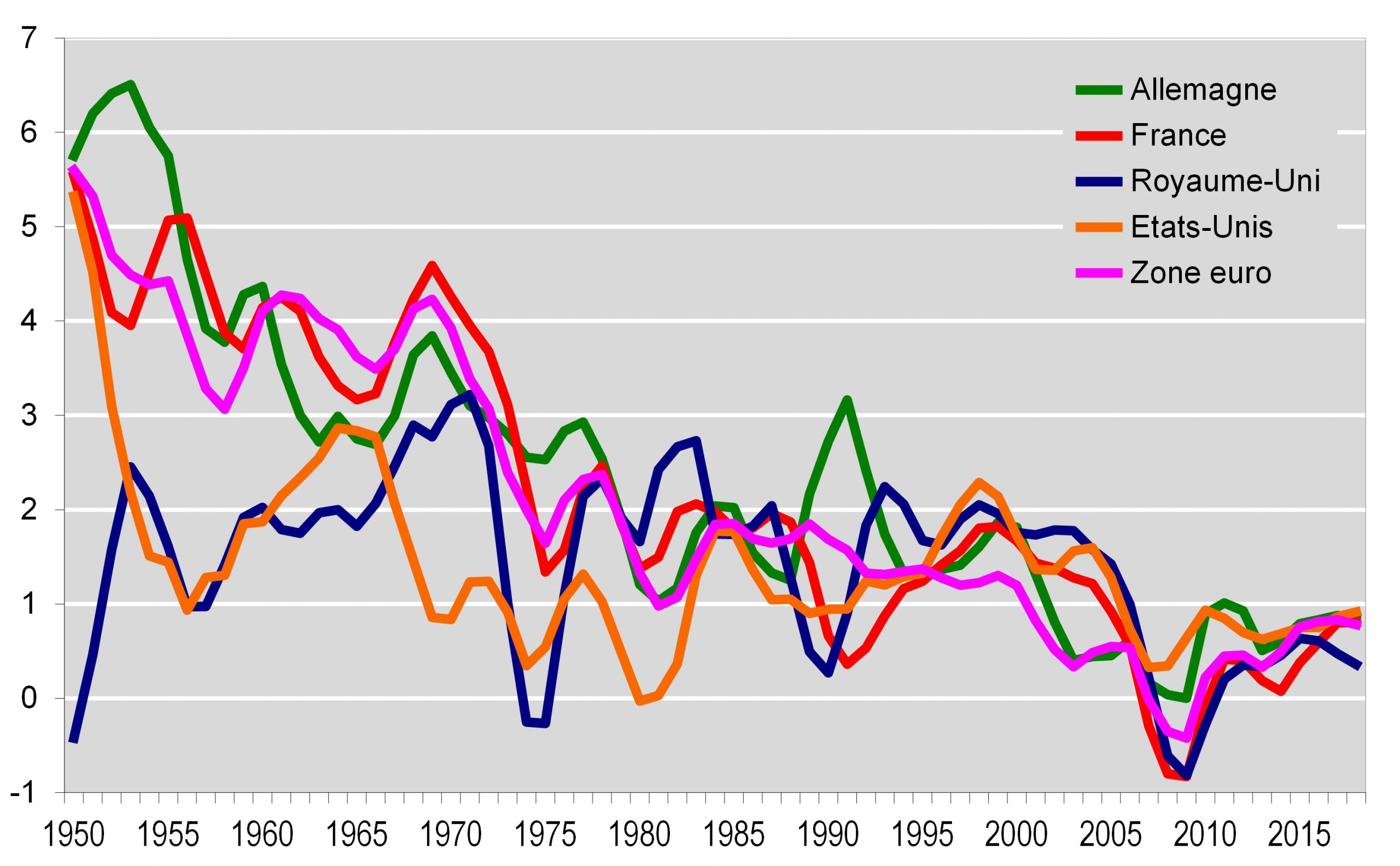

Could the crisis be an opportunity to put an end to the downward trend in productivity gains? This exhaustion of productivity gains is indeed an essential characteristic of contemporary capitalism: during the post-war boom, labour productivity increased by around 5% per year. Today it is at best only 1% or 2%. This is true for the main capitalist countries.2

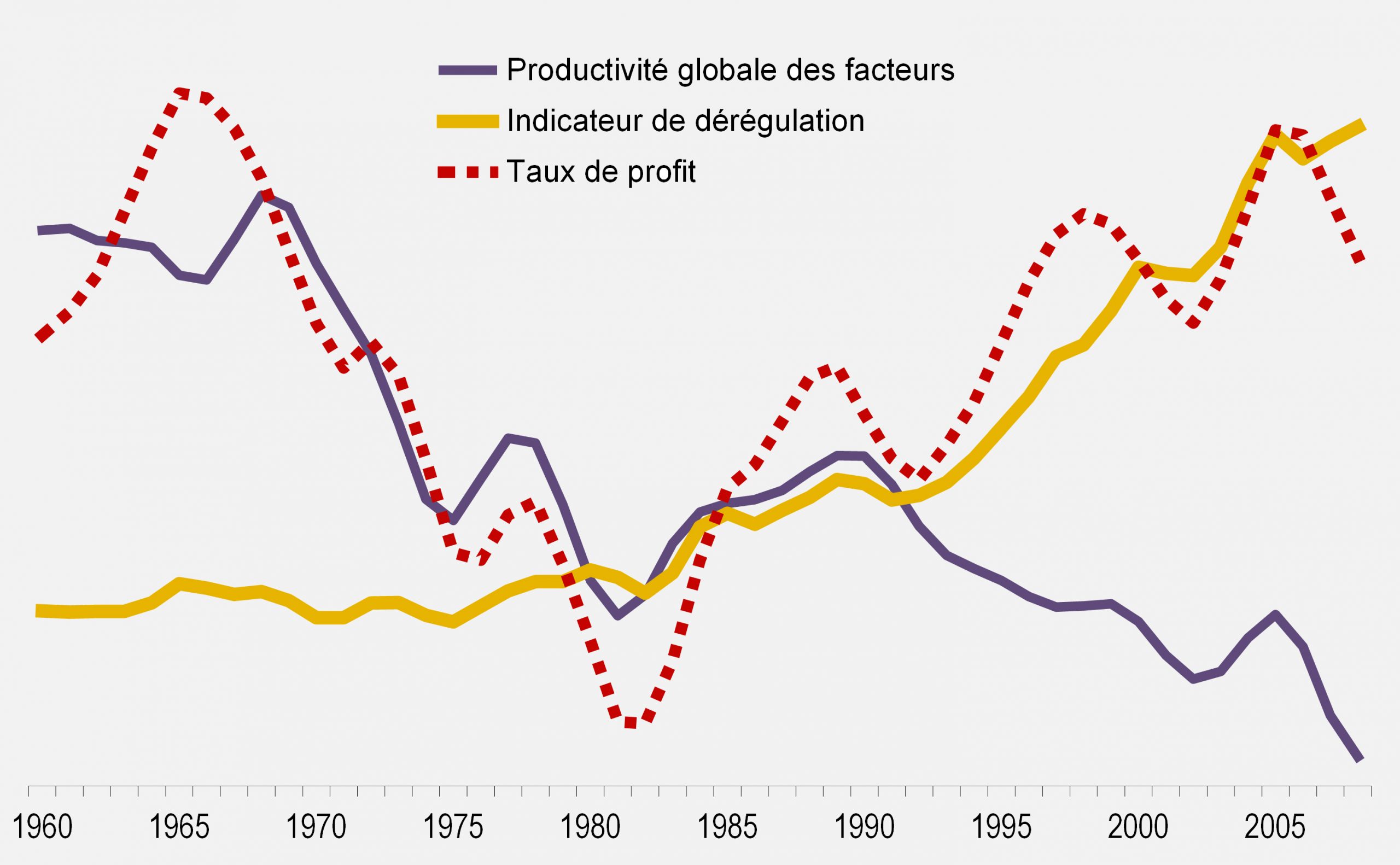

This is a major transformation in the dynamics of capitalism, the importance of which is often underestimated, for example in the recent books by Thomas Piketty or Branko Milanovic.3 However, the arithmetic is simple: the evolution of the rate of profit depends on the gap between the growth of labour productivity and that of wages, taking into account the increase in capital. In technical terms, the rate of profit increases if wages increase less quickly than “total factor productivity”, which is the average of labour productivity and capital efficiency.4 It is from this arithmetic that we can analyse the transition to neoliberal capitalism, which took the form of a process of deregulation.

Deregulation as a substitute for productivity

Deregulation is defined here in the broad sense as the set of devices aimed at restoring profit, despite the exhaustion of productivity gains. We compare the changes in the rate of profit and productivity with that of a synthetic “deregulation indicator”, constructed from a battery of indicators (wage share, trade deficits, household debt, inequalities, financialization, globalization).5

The graph below illustrates this comparison, which covers the set formed by the main capitalist countries (the variables are normalized). We see the two great phases of the history of contemporary capitalism emerging. The first is characterized by a parallel decline in productivity gains and the rate of profit. But at the same time, the deregulation index remains roughly constant. In other words, we are gradually seeing the dynamism of a capitalism that remains relatively “regulated” exhausted.

From the mid-1980s, the neoliberal period, whose configuration was quite different, began. As productivity gains continue to slow, the rate of profit starts to rise again at the same time as the indicator begins to rise. In the first phase, where the rate of profit and productivity are closely correlated, the dynamics of capital are based on productivity gains. In the second phase, it is striking to note that profit and productivity evolve strictly in the opposite direction. The correlation is now between profit and deregulation, which thus takes over from productivity gains to ensure the restoration of the rate of profit. This modelling where the rate of profit depends alternatively on productivity and deregulation can also be tested econometrically.6

The productivity mystery

The problem is that we do not understand the reasons for this slowdown in productivity: normally, the development of new technologies should have boosted labour productivity. This is the famous paradox of Solow, the economist who had observed already in 1987 that “you can see the computer age everywhere but in the productivity statistics.”7

The mystery remains unsolved today. It’s been argued that there was a measurement problem, that the prices were overestimated, that there were delays (but we've been waiting a long time!) but this is unconvincing. We also demonstrated the difficulties encountered in modelling attempts where the decline in productivity gains is explained by the passage of time.8

Yet, and this is another paradox, there have been many catastrophic predictions in recent times. The widely cited benchmark study is that of Frey and Osborne which predicted in 2013 that 47% of US jobs would be threatened by automation over the next two decades.9

However, the most detailed and serious studies so far do not show a negative effect of robotization on total employment. In contrast, the increased use of robots is reducing the share of workers performing routine tasks, especially manual ones. This is confirmed by a recent study which gives the example of the sites of Adidas, in Ansbach in Germany or Atlanta in the United States, which produce thousands of shoes per year using industrial robots and a handful of workers. The authors point out that “previously these production tasks would have taken place in places where labour is less expensive, such as in Southeast Asia.”10

Another study from Germany also finds that robotization has no effect on total employment. But it has had a negative impact on employment in industry: the authors calculate that an additional robot replaces on average two jobs in the manufacturing sector. Robots are therefore responsible for nearly 23% of the drop in industrial employment between 1994 and 2014.11

All these studies therefore converge to find an effect of automation on the structure of employment. It is evident that routine and low-skilled tasks are more likely to be automated than specialized and more skilled tasks. To put it simply, robots or computers replace routine work and support more specialized tasks with which they are complementary. Pay inequalities can therefore only increase between the two categories of workers.

This mechanism is actually as old as capitalism. Already in 1845, Engels could observe it with the introduction of the Mule (a spinning machine with hydraulic energy) in the cotton mills: “The so-called fine spinners (who spin fine mule yarn), for instance, do receive high wages, thirty to forty shillings a week, because they have a powerful association for keeping wages up, and their craft requires long training; but the coarse spinners who have to compete against self-actors (which are not as yet adapted for fine spinning), and whose association was broken down by the introduction of these machines, receive very low wages.”12

In the sectors concerned, it goes without saying that robotization contributes to increasing productivity. But the studies which confirm this evidence do not explain the overall slowdown in productivity gains.13 There is therefore a “decreasing marginal productivity” of robotization. The mystery thus remains unresolved.

Patrick Artus, an economist who is by no means a Marxist, opens up an interesting avenue.14He notes that everything seems to be going in the direction of an acceleration of productivity: robotization of workplaces, new workplace technologies, research and development, level of education. He also shows that neoclassical theory cannot account for the phenomenon: “the increasing substitution of capital for labour should lead to an acceleration in labour productivity, but on the contrary, this has slowed down”. His explanation is that in fact the net investment rate (which takes into account capital depreciation) has fallen significantly. In other words, “companies have not invested enough to offset the acceleration of capital obsolescence, hence the decline in productivity gains”.

Here we have a first possible explanation. Despite the decline in the relative price of investment goods in new technologies, the volume of capital required is increased, especially since it is subject to a relatively short life cycle. In other words, you have to invest a lot and often, and the same volume of investment brings decreasing productivity gains. But this explanation must be coupled with another, namely the mismatch between social demand which is moving towards sectors with lower productivity and capitalist profitability criteria. Perhaps this is the basic answer to Solow’s paradox: the flow of technological innovation does not seem to be drying up, but the capacity of capitalism to incorporate this into its logic is running out.

After (?) Covid-19

The Covid-19 crisis has led to a sharp decline in employment and working hours around the world. The International Labour Organization estimates that the total number of hours worked worldwide fell by 17.3% in the second quarter of 2020 compared to the last quarter of 2019, or the equivalent of 495 million full time jobs. Low-income countries are the most affected, with a 23.3% drop in hours worked, or the equivalent of 240 million full-time jobs.15

The fall in employment, however, has been cushioned by a reduction in working hours, in various forms such as short-time working: it is a bit of a tribute of vice to virtue. In France, the number of hours worked in the whole economy fell by 1.7 billion, or 4%, in the first two quarters of 2020. But more than 80% of this decrease was covered by short-time working or other equivalent measures.16 This “forced” reduction of working hours (which lowers labour productivity) is something the bosses will seek to dispense with as quickly as possible.

Meanwhile, the game of predictions continues. According to the McKinsey Global Institute, “22% of work posts could be automated by 2030” in Europe, equivalent to 53 million jobs.17A survey conducted by the same institute among 800 business leaders around the world shows that they have already accelerated computerization and automation during the pandemic.18 Their effort has mainly focused on teleworking. These same executives believe the demand for “self-employed and temporary on-site workers” is expected to increase over the next two years. The Covid-19 crisis would thus open a period of resumption of productivity gains.

Jobs doubly exposed in Europe

| Wholesale and retail trade | 5,4 |

| Industry | 4,3 |

| Hospitality | 3,0 |

| Construction | 2,4 |

| Logistics | 1,5 |

| Health and Social Work | 1,5 |

| Public administration | 1,0 |

Millons. Source : McKinsey

But this is to forget one of the characteristics of the double shock to supply and demand inflicted by the pandemic, namely its heterogeneity between sectors (and countries). Therefore, even a gradual revival of the economy would not reduce the imbalances between supply and demand, as a careful study points out.19 The McKinsey study on employment in Europe, already cited, sheds a useful light from this point of view: alongside the 22% of jobs threatened by automation, it identifies 26% of jobs threatened by Covid -19. These two categories overlap in part: 10% of European jobs are thus threatened by both automation and Covid-19. These “doubly exposed” jobs are very unevenly distributed by sector. Thus 5.4 million retail jobs (or 2 out of 3) would be exposed to this double risk.

This differentiation would be particularly unfavourable to women, and this is an important difference from the previous crisis. They are “about twice as likely as men to be in jobs with high risk of Covid-19 transmission and automation. Women with an average level of education face the highest joint risk from transmission of Covid-19 and automation.20

Companies will therefore be encouraged to robotize in order to increase productivity, but also to reduce uncertainty as to the effective availability of labour, given health measures. However, uncertainty is also weighing on business prospects, which will have the effect of dissuading companies from investing, especially as their profitability has deteriorated: “the uncertainty as to the duration of the pandemic weighs heavily on investment and hinders trade; foreign direct investment and mobility restrictions could further slow down the reallocation of workers from low-productivity firms to higher-productivity firms”.21

It is therefore difficult to say which of these two trends will prevail, and the answer will probably be very different from one sector to another.22 However, an examination of the previous epidemics which preceded Covid-19 (SARS, MERS, Ebola, and Zika) shows that productivity would have been reduced by 4% after three years, due to their disruptive effects: dislocation of the labour force, credit restriction, disorganization of value chains, decline in innovation.23

Towards a “V” recovery of profit?

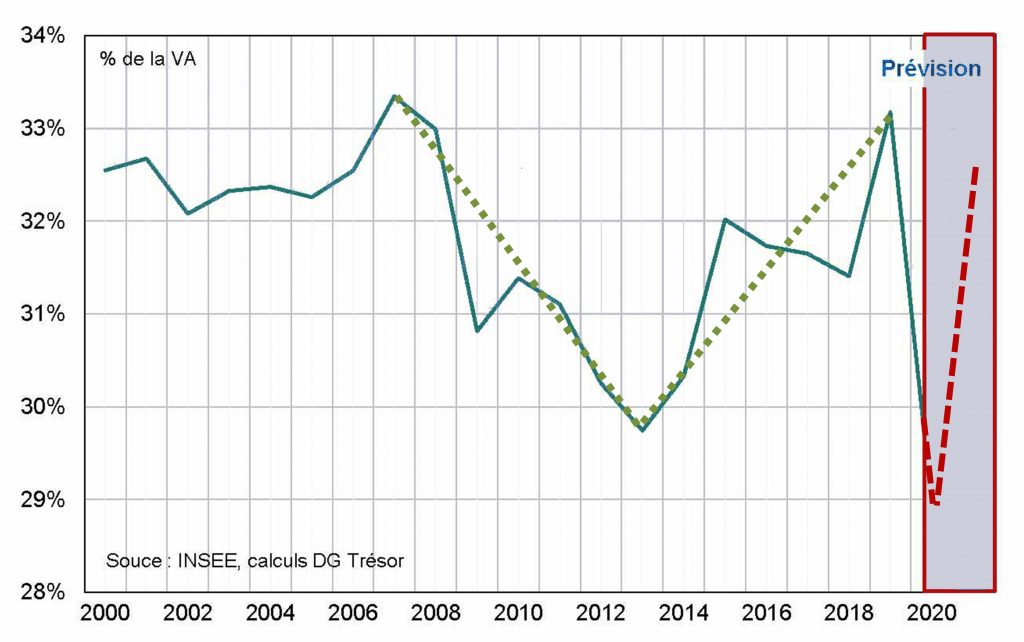

A diagram from the French Economy Ministry’s “Rapport économique, social et financier” (referenced above) is particularly revealing of the challenges of the period. It represents the marginal rate, in other words the share of profit in the added value of French companies. We can see that it tends to increase, before falling with the 2008 crisis. From 2013, it recovers to return to a historically high level: this double movement of fall then recovery results in a “V shaped recovery” for profits. Then comes the Covid-19 crisis, which brings it down sharply, roughly to the same level as in the previous crisis.

This diagram’s forecasts are shown in dotted lines. We can then decipher the perspectives of the French government: to catch up in one year a decline in profit of the same order of magnitude as that which had required seven years previously. This goal of a rapid “V-shaped” recovery in profit rests on the simplistic assumption that the speed of the catch-up will necessarily be proportional to the speed of the fall. But above all, it reveals the desire to restore profit “whatever it costs” ... to workers.

The conclusion of this brief review could be formulated in the form of mini-theses:

- The productivity of labour is an essential factor in the dynamic specific to capitalism. However, it has been exhausted for several decades: automation is not producing the expected results.

- The Covid-19 crisis has had the effect of reducing productivity, in a differentiated manner according to sector.

- For capitalists, the essential issue in exiting the crisis is to restore their profit, in which productivity is a major component. Automation can help, but it requires a resumption of investment which is doubtful.

- The increased use of automation can only further accentuate the fragmentation of the workforce.

- 1Michel Husson, “Le grand bluff de la robotization”, A l’encontre, 10 June 2016; “Stagnation séculaire: le capitalisme embourbé?”, A l’encontre, 5 June 2015

- 2Source: Antonin Bergeaud, Long-Term Productivity Database, October 15, 2019.

- 3Thomas Piketty, Capital and Ideology, 2019; Branko Milanovic, “Capitalism, Alone”, 2019.

- 4See Michel Husson, “Taux de profit, salaire et productivité”, note hussonet number 94, 4 March 2016.

- 5The mode of construction of the index of deregulation is explained in “Le néolibéralisme, stade suprême?”, Actuel Marx number 51, 2012.

- 6See Michel Husson, “Petite économétrie du capitalisme néolibéral”, note hussonet number 124, 8 September 2018.

- 7Robert Solow, “We’d Better Watch Out”, New York Times Book Review, 12 July, 1987.

- 8See Michel Husson, “Productivité: l’énigme irrésolue”, Alternatives économiques, 10 February 2020; “ Comment l’Insee explique (ou pas) le ralentissement de la productivité”, Alternatives économiques, 19 July 2018.

- 9Carl Benedikt Frey, Michael A. Osborne, “The future of employment: How susceptible are jobs to computerisation?”, 17 September, 2013.

- 10Elisabetta Gentile et al., “Robots replace routine tasks performed by workers”, voxeu, 8 October, 2020.

- 11Wolfgang Dauth et al., “The rise of robots in the German labour market”, voxeu, 19 September, 2017.

- 12Friedrich Engels, “The Condition of the Working Class In England”.

- 13For example: Georg Graetz & Guy Michaels, “Robots at Work”, The Review of Economics and Statistics, vol. 100 number 5, December 2018.

- 14Patrick Artus, : “Sur le ralentissement de la productivité”, 25 September & 1 October 2020.

- 15https://www.ilo.org/global/topics/coronavirus/impacts-and-responses/WCMS_755910/lang--en/index.htm

- 16Source: French Economy Ministry, “Rapport économique, social et financier”, 2021.

- 17McKinsey Global Institute, “The future of work in Europe. Automation, workforce transitions, and the shifting geography of employment”, June 2020.

- 18McKinsey Global Institute, “What 800 executives envision for the post pandemic workforce”, September 2020.

- 19Maria del Rio-Chanona et al., “Supply and demand shocks in the COVID-19 pandemic: an industry and occupation perspective”, Oxford Review of Economic Policy, Vol. 36, Sup. 1, 2020.

- 20Alex W. Chernoff, Casey Warman, “Covid-19 and implications for automation”, NBER, July 2020.

- 21Alistair Dieppe, “Slowdown in productivity growth compounded by COVID-19”, voxeu, September 18, 2020.

- 22See this attempt at modelling: Sylvain Leduc and Zheng Liu, “Can Pandemic-Induced Job Uncertainty Stimulate Automation?”, Federal Reserve Bank of San Francisco, May 2020.

- 23Alistair Dieppe, Sinem Kilic Celik, Cedric Okou, “Implications of Major Adverse Events on Productivity”, The World Bank, September 2020.