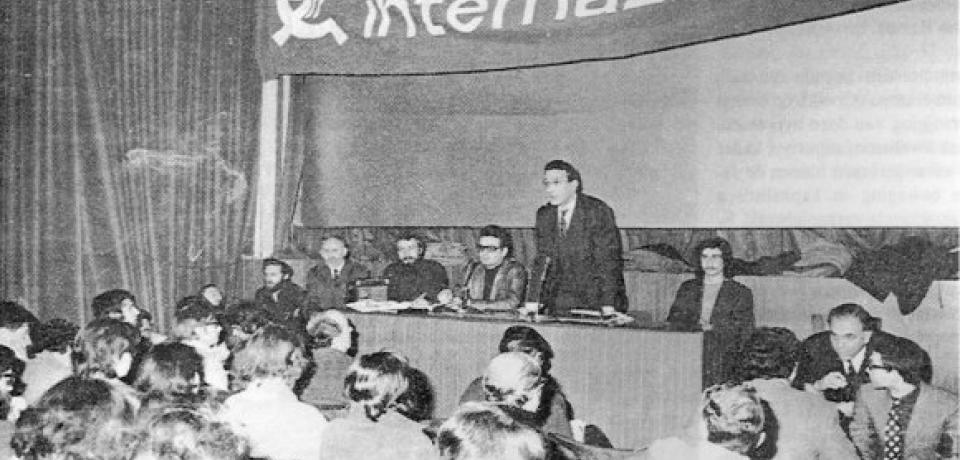

Belgian Marxist Ernest Mandel explained long waves as a key factor in capitalism's development. Mandel’s theory is one of the most sophisticated attempts to show why capitalism goes through extended periods of expansion and stagnation.

From Carlota Perez to Paul Mason and Cédric Durand, many analysts of contemporary capitalism have embraced the concept of long waves that the Russian economist Nikolai Kondratiev first put forward. But if capitalism develops through long waves, with upswings and downswings in its trajectory, what is the logic underpinning such waves?

The Belgian Marxist Ernest Mandel offered one of the most detailed explanations in his book Long Waves of Capitalist Development, based on a series of lectures given by the author at the University of Cambridge in 1978. For Mandel, the existence of these “long waves” is an empirically established fact. Its Marxist explanation is essentially based on the long-term fluctuations of the profit rate, which, in turn, ultimately determine the pace of capital accumulation (i.e., economic growth and expansion in the world market).

Mandel cites two crucial indicators that empirically confirm the existence of “long waves,” namely industrial production and the growth of exports as a whole. The data indicates the following time periods with an ascending or a stagnating-depressive tendency: 1826–47 (stagnating-depressive); 1848–73 (expansive); 1874–93 (stagnating-depressive); 1894–1913 (expansive); 1914–39 (stagnating-depressive); 1940–67 (expansive); and from 1968 on, again a long wave with a stagnating-depressive tendency.

Explaining Long Waves

From a Marxist point of view, long-term industrial growth under capitalism is unthinkable under conditions of a falling rate of profit. Insofar as, again from a Marxist perspective, the long-term tendency of the rate of profit to decline is claimed to hold true for the overall development of capitalism, there obviously arises the problem of explaining prolonged phases of growth. From this emerges the need not only to examine the fluctuations of the rate of profit in the context of the business cycle and its secular tendency, but also to introduce a third time frame, namely “long waves.”

In general, expansive long waves occur when the factors that counteract the fall in the rate of profit have a strong and synchronous effect.

The sudden rise in the average rate of profit over a prolonged period could be explained with reference to a number of factors. Mandel cites a sudden rise in the rate of surplus value as the first. A sudden slowdown in the growth of the organic composition of capital, a sudden increase in the rate of capital turnover, or a combination of these factors are also possible. Mandel cites other potential causes, such as a sharp increase in the surplus value mass and a strong flow of capital to countries with a significantly lower organic composition of capital than in metropolitan areas.

In general, expansive long waves occur when the factors that counteract the fall in the rate of profit have a strong and synchronous effect. However, we must also try to explain why the counteracting tendencies do not prevail within the individual long wave. According to Mandel, the fluctuations of the “reserve army,” i.e., the relative weight of unemployment, play an important role there.

One of Mandel’s main theses is that in contrast to the normal capitalist business cycles, where transitions to depression and to recovery both correspond to internal laws of the capitalist economy, the transition to a long wave with an expansive basic tendency must be explained by noneconomic (“exogenous”) factors. This is precisely why Mandel, unlike Nikolai Kondratiev, does not speak of “long cycles,” but of “long waves.”

In his opinion, the “long wave” with a depressive basic tendency does not contain in itself, in purely economic terms, the conditions for changing over to a “long wave” with an expansive basic tendency. Conversely, a “long wave” with an expansive basic tendency contains in itself the conditions for turning over to a “long wave” with a stagnating-depressive tendency.

Exogenous Factors

To explain the sudden and permanent increases in the average rate of profit after 1848, 1893, and 1940 (or 1948 in Europe), Mandel identifies specific noneconomic factors for each of these periods. The year 1848 was characterized by revolutions, conquests, and the discovery of the Californian gold fields. These three factors brought about a qualitative expansion of the capitalist world market.

A ‘long wave’ with an expansive basic tendency contains in itself the conditions for turning over to a ‘long wave’ with a stagnating-depressive tendency.

Industrialization and the technological revolution associated with it were massively advanced. This process was marked above all by the transition from steam engine to steam motor, and by the transition from the artisanal to the industrial production of fixed capital. This allowed for a spectacular increase in labor productivity and, due to the increase in relative surplus value, also in the rate of surplus value.

In addition, the use of steamships, telegraphs, and railways brought about a revolution in transport and telecommunications technology, accelerating the speed of capital turnover. This was augmented by the spread of joint-stock companies and the emergence of large department stores, which boosted the realization of surplus value. According to Mandel, all this combined led to a permanent growth in the rate of profit.

The analogous explanatory features for the onset of an expansive long wave after 1893 coincide with the main features of incipient “imperialism” in Vladimir Lenin’s sense of the term: the division of the world between the developed capitalist industrial countries, an increase in capital exports to the poor, backward, and dependent countries, and a fall in relative commodity prices. The growth rate of the organic composition of capital declined, and the technological revolution brought about by general electrification in the rich industrialized countries in turn enabled increased production of relative surplus value.

For the expansive long wave after 1940 (in the United States) and 1948 (in general), Mandel cites “historical defeats of the international working class” as the main explanatory factor. Fascism and Nazism were responsible for the destruction of the labor movement in the affected countries. World War II, the subsequent Cold War, and the McCarthy era in the United States were further huge setbacks for the organized labor movement and its ability to effectively defend the interests of wage earners.

All these factors together allowed for sensational increases in the surplus value rate, in some cases up to 300 per cent. Once again, the growth of the organic composition of capital slowed down, this time due to cheaper access to Middle Eastern oil, a further drop in raw material prices, and a price drop for elements of fixed capital.

A renewed revolution in telecommunications and lending, the emergence of a real international money market, and the proliferation of multinational corporations were all factors in the new situation. For Mandel, the expansion of arms production with state-guaranteed profits plays a very important but not decisive role in this context.

Technological Revolutions

Mandel argues that, while “exogenous factors” ought to be viewed as “triggers” in the respective instances, they unleashed a dynamic process that was self-perpetuating for decades, which in turn can be explained with the aid of the traditional Marxist categories of the critique of capitalist economy. What role do the technological revolutions play in Mandel’s explanatory model if he does not believe that they can trigger periods with an expansive basic tendency?

In the period of long waves with a stagnant-depressive basic tendency, a “reserve” of technological innovations develops, but they are not introduced into the production process on a massive scale. The same is true for money reserves. Only a change in the economic climate and accordingly higher profit expectations prompt massive investment with the purpose of using these innovations in production.

During an expansive wave, the average labor productivity in the technologically more advanced companies determines value. Companies that use more advanced technology for production realize extra profits. This is where value is determined by the new industrial sectors that drive the technological revolution and have the highest production costs. Hence, they not only generate surplus value at the expense of less productive companies, but also drive up the average rate of profit.

During an expansive wave, the average labor productivity in the technologically more advanced companies determines value.

At the beginning of an expansive long wave, the working class still suffers from the consequences of the previous era and is therefore not in a position to stop the decline in wages relative to profits at once. Real wages begin to rise in the subsequent period, but only very gradually — notably more slowly than productivity is increasing in “department II” (the production of articles of consumption). A greater rate of immigration also counteracts the increase in real wages.

For this reason, the surplus value rate may continue to grow for quite some time, despite the rise in real wages. Expansive waves typically contain business cycles with longer and more pronounced phases of boom and shorter and less pronounced crises, milder forms of which are perceived as “recessions.” During a stagnating-depressive wave, the opposite is true, although even during such long waves there are, of course, periods of economic boom.

Further aspects that Mandel adds to his explanation are long-term trends in competition between the leading capitalist nation states and fluctuations in gold production. The first two expansive long waves coincide with British hegemony, the third with the hegemony of the United States as the leading imperialist power.

In Mandel’s view, the significance of the hegemonic country’s power to manage global crises is obvious — therefore, the relative decline of US dominance makes it more difficult to counter a generalized crisis-like development. In general, drastic changes in the political balance of power in the world arena are important (noneconomic) factors that shape the general economic climate of the era.

The Golden Rule?

Mandel mentions that many economic historians have been “fascinated” by the thesis, based on the work of Gustav Cassel, that long waves are determined by the long-term fluctuations in gold production. However, he considers this thesis untenable from a Marxist point of view. Its flaw is that the average value of commodities, and therefore the general trend of prices, is not determined by the quantity of gold but by its value.

In the nineteenth century, factors of “chance,” such as the discovery of rich new gold fields, played an important role, since they radically pushed down the value of gold, thus helping to boost the rate of profit through general price rises. In the twentieth century, in contrast, gold mining itself became a capitalist industry, and therefore subject to the logic of capitalist production, since the discovery of South African gold mines.

For Mandel, there is an interplay between technological revolutions, advances in science, and the internal logic of capitalist development.

For Mandel, there is an interplay between technological revolutions, advances in science, and the internal logic of capitalist development. He argues that it is a fundamental tendency of capitalism to transform scientific labor into a specific form of wage labor. This tendency has only been comprehensively realized in late capitalism.

It was preceded by two phases. In the first, the experimentation of craftsmen was the direct basis for most advances in manufacturing. In the second, the observations of engineers made this process more systematic. In this way, a synthesis of “abstract science” and “concrete technological inventions” appeared: “applied science.”

According to Mandel, the tendency to subsume scientific labor into the production process stems from capital’s “unrelenting thirst for more . . . surplus value” and is interconnected with the rhythmic movement of capital accumulation. Of course, there will be some investment in research in the course of a long wave with a stagnating-depressive undertone, but the main objective will be technological breakthroughs aimed at radical cost reductions.

Investment expenditure aimed at the massive introduction of new technologies into the production process generally begins about ten years after the beginning of an expansive long wave. While the basic correlation is clear, Mandel warns that we must not interpret it too mechanically. The same is true, according to him, for the correlation between a particular, fundamentally new technology and specific types of labor organization.

However, the following four machine systems broadly correspond to four different types of labor organization: craftworker-operated and craftworker-produced machines driven by the steam engine; machinist-operated and industrially produced machines driven by steam motors; assembly-line combined machines tended by semiskilled machine operators and driven by electric motors; continuous-flow production machines integrated into semiautomatic systems controlled by electronics.

The introduction of each of these successive radically different types of technology historically involved strong resistance from wage laborers. The reason for the introduction of new systems of labor organization was in each case an attempt by capital to break down growing obstacles to further increases in the rate of surplus value. The rhythmic long-term movement of capital accumulation is thus connected to capital’s greater or lesser push toward radical changes in labor organization.

This interest is less urgent for most of the duration of a long wave with expansionary undertone, where the need to reduce social tensions and mitigate the causes of resistance and rebellion predominates. Conversely, when an expansionist wave ends and a wave with stagnating-depressive undertone begins, capital’s interest in radical changes in labor organization will increase despite the risk of growing social tensions, which cannot be avoided anyway.

Long Waves and Class Struggle

Mandel also tried to establish a correlation with “class-struggle cycles,” i.e., with the ups and downs of working-class mobilization in defense of class interests, or indeed with the surging and declining intensity of struggles between labor and capital. Taylorism (assembly-line labor) and semiautomation (electronics) were each introduced for the first time, or experimentally, near the end of a long wave with an expansionist undertone, but were not generally applied until the subsequent long wave with a stagnant-depressive undertone.

Major historical events and the outcomes of major historical conflicts cannot simply be deduced from the laws of capitalist movement.

According to Mandel, these findings confirm the following correlation with “long waves.” Initially, new technologies have an “innovative character” and push up the average rate of profit. Then, in the long periods during which the take the form of generalization, they push down and hold down the average rate of profit. Furthermore, any revolutionary innovation in labor organization grows out of attempts to break down working-class resistance to further increase the rate of surplus value, i.e., the rate of exploitation.

The first technological revolution was therefore also a response to the working-class struggle for a shorter workday. The second one was closely related to the resistance against stricter and more direct control by management over the work process. Finally, the third technological revolution was a response to the growth of trade union organization and the efforts of workers and their unions to weaken the power of control of management over conveyor belt production.

The interplay of “subjective factors” (the strength, confidence, and class consciousness of the proletariat) is decisive for the capacity of reversing a long-term trend in the rate of surplus value and therefore also in the rate of profit. Thus, the consequences of the class struggle of a whole historical period appear to Mandel as “exogenous factors” determining the turning points. This is the dialectic between objective and subjective factors, in which the latter are characterized by “relative autonomy.”

Mandel assumes a cycle of class struggle that is interwoven with “long waves,” although it does not simply run parallel with them. According to Mandel, major historical events and the outcomes of major historical conflicts cannot simply be deduced from the laws of capitalist movement. That would be crude “economism.” Nevertheless, major trends have objective economic roots.

This article was first published on Jacobin. This is an extract from Against Capitalism and Bureaucracy: Ernest Mandel’s Theoretical Contributions by Manuel Kellner, available in paperback this April from Haymarket Books.