The term “polycrisis,” used by the American economic historian Adam Tooze to characterize the current situation where several crises, current or potential, interact – has a certain vogue today. “A polycrisis is not just a situation where you face multiple crises. It is a situation like that mapped in the risk matrix, where the whole is even more dangerous than the sum of the parts. A polycrisis is not just a situation where you are faced with multiple crises. This is a situation . . . when the whole is worse than the sum of its parts.”1 The world economy is indeed going through a phase of economic crisis with significant recessionary tendencies. But in fact this is only one element of a complex situation:

- Capitalism has probably entered a phase of long depression...

- where it is increasingly on a public drip while economic policy dilemmas increase,

- while from an economic and geopolitical point of view, a “tipping of the world” is taking place, marked above all (but not only) by the rise of China. Inter-imperialist contradictions are growing. Meanwhile, the ecological crisis forms an increasingly immediate background.

This first part attempts to shed light on the situation of the world economy in ten points.

1. A sharp slowdown in economic growth

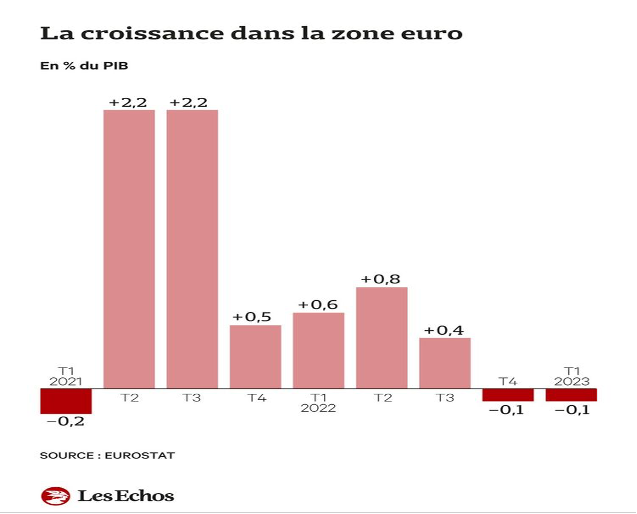

- In Europe. According to figures published in early June 2023, the GDP of the bloc of twenty countries in the euro zone has declined for two quarters in a row, with a contraction of 0.1% between January and March 2023, following a decline of the same magnitude between October and December 2022. Even if these are limited declines, the euro area officially entered a technical recession at the beginning of 2023. This recession is particularly pronounced in Germany.

At the global level, the underperformance is mainly due to weak domestic demand. Public spending is falling sharply, while household consumption is struggling amid inflation and tighter credit conditions.

In France, according to INSEE forecasts, annual GDP growth will fall from 2.5% in 2022 to 0.6% in 2023. The effects of tighter monetary policy (see below) will begin to be felt. Household real estate purchases are expected to decline in 2023. Business investment is also expected to slow down (+2.5%), held back by the rise in interest rates. Finally, job creation is expected to fall to around 175,000, whether salaried or not, against 445,000 last year.

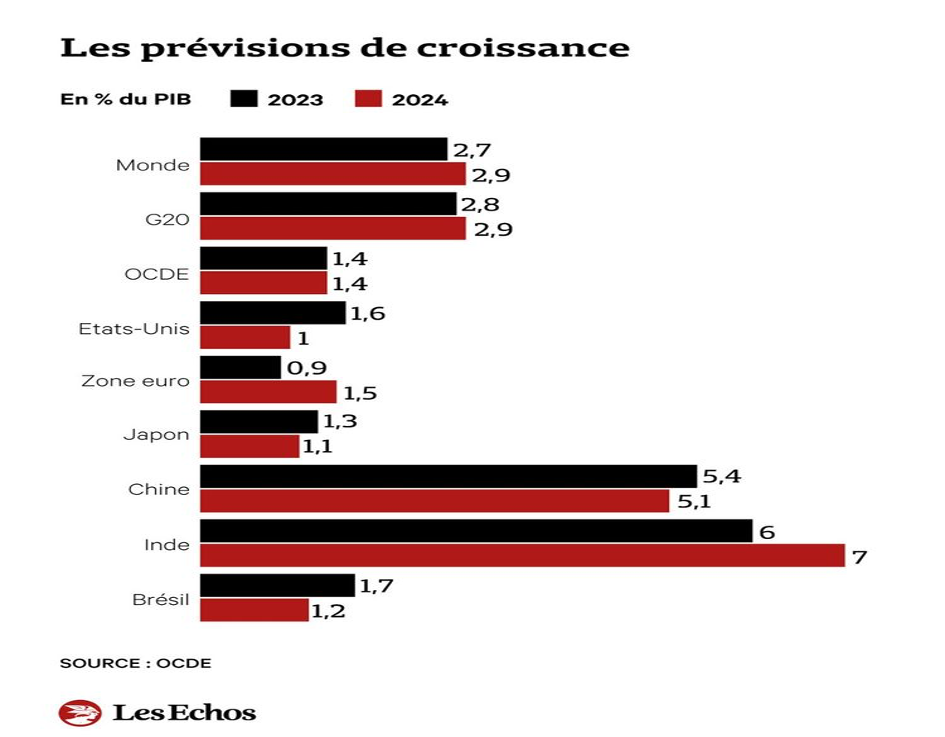

- In the world. According to OECD forecasts, the slowdown is marked in the main countries. U.S. growth, 1.6% this year, is expected to slow to 1% in 2024.

China's GDP grew by only 3% in 2022. Far from the official target of 5.5%, and one of the weakest rates in four decades. Beijing's target of “around 5%” growth this year – one of the weakest in decades – is still wishful thinking.

2. Rising interest rates. The decision by governments and central banks to raise interest rates to combat inflation is one of the reasons for stagnation (or even recession) and has a series of knock-on effects. It is through economic slowdown and unemployment that monetary policy intends to fight inflation to the detriment, of course. of the popular classes.

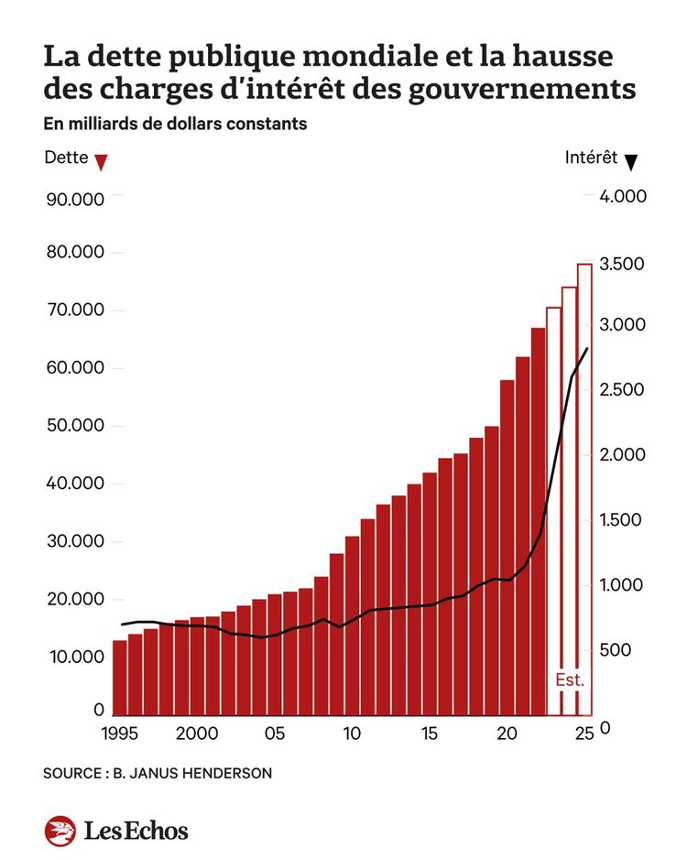

3. A sharp increase in public and private debt. Global public debt has doubled in 11 years. It grew by nearly 8% last year – at constant exchange rates – to a record $66.2 trillion.

Interest rates, which had been low for a long time, have risen as a result of central bank policy (rising rates, stopping purchases of securities). According to Janus Henderson, interest costs will reach $2.8 trillion in 2025, or 2.8% of expected global GDP. This is double the average of the last 10 years. Borrowing costs have more than doubled since 2021 for OECD countries.

But it is the poor countries that are in the most difficult situation. After three decades of sharp decline, extreme poverty has been on the rise again over the past three years. The resurgence of inflation, amplified by the war in Ukraine, has complicated the situation since autumn 2020. Rising interest rates only further strangle poor countries. Interest rate spreads with U.S. Treasury securities have exploded. A large part of their public revenues is devoted to debt servicing: 26.8% in 2021 for Senegal, for example (compared to 7.6% in 2011). On the one hand, the disruption of supply chains (with the health crisis and then the war in Ukraine and climate disasters) has pushed up food and energy prices, fueling the spiral of misery. On the other, debt has stifled their post-Covid recovery. With the rise in interest rates over the past year, the debt burden threatens some states with bankruptcy. According to the World Bank, sub-Saharan Africa now accounts for 60% of the world's extreme poverty and continues to see it increase.

4. Speculative bubbles that can burst at any time and a weakened financial system as evidenced by bank failures in March 2023 (four US regional banks and Credit Suisse). The current phase of capitalism remains characterized by the hypertrophy of finance capital, which is a symptom of the latent crisis of the system, of blockages of accumulation. Finance is now decompartmentalized: geographically and between the different markets where it is possible to make money. Financial instruments continue to multiply. The big financial players are becoming more powerful and the industrial oligopolies are financialized.

It should be remembered that finance does not create surplus value but gives a right of drawing on the surplus value produced elsewhere. This is manifested first and foremost in the present situation by the increase in dividends paid to shareholders. See Oxfam's June 2023 report.2

5. Inflation is slowing down but remains high and leads to a decline in the purchasing power of the working classes. Thus, in France, inflation weighs on consumer spending, which forms the most powerful component of growth. Last year, revenues increased 5.1%. But as consumer prices (according to the official index, the CPI, which has limits, rose by 4.8%, purchasing power increased by only 0.3%3

This downward trend has become more pronounced. In the first quarter of 2023, wages grew less quickly than prices. Purchasing power fell 0.6%. Purchases of goods, which had jumped after the lockdowns, have been on a downward slope since the end of 2021, with dramatic falls on the products that have risen the most. Thus, soaring food prices – which reached 13.7% between June 2002 and June 2023 according to INSEE – are reflected in an unprecedented drop in food consumption (-9.7% over one year) revealing the deprivations that weigh on many households. Beyond averages, the impact of rising prices is greater for low and middle incomes: most of their monthly earnings go to consumption (high incomes obviously have a greater savings capacity) and food (and often energy) expenses constitute a greater proportion of family budgets. These expenses depend largely on factors over which households have little control in the short term: family composition, places of residence and work, the way the home is heated and so on.

Despite this observation, which can be transposed to many countries, the Fed (US Federal Reserve) and the European Central Bank (ECB) remain focused on wage increases (as evidenced by Christine Lagarde's statements at the end of June), although various diagnoses show that it is profits that are primarily responsible for the current price slippages (see below).

7. Supply of goods: Supply chain disruptions related to containment measures during the coronavirus pandemic in 2020 and 2021 (up to and including 2022 for China) disrupted production. They are still not completely absorbed for the microprocessor sector, whose production is concentrated in a few countries (Taiwan produces 90% of the most efficient “chips”). Producers are struggling to meet demand (political factors linked to US policy towards China also complicate the situation).

8. One economic sector is currently experiencing a marked expansion: the military sector. Beyond current events, military spending and wars are intrinsically linked to capitalism and more precisely “armed globalization”, to use a concept put forward by Claude Serfati but the impact of military spending on the economy is much discussed among economists of various ideological persuasions.4

- This certainly has a Keynesian effect (income distribution and support for certain industries), making it possible to compensate for the shortfall in aggregate demand. Marxist authors, including Ernest Mandel, emphasized their impact on industry and opportunity. Mandel writes in particular about the role of arms spending: “This confirms Rosa Luxemburg's diagnosis before the First World War. It saw in the arms economy 'the substitute market' – that is, new outlets for the sale of commodities and the realisation of surplus value – par excellence in the imperialist epoch.”5

- But in the long term, there is no consistent relationship between the weight of military spending in a state’s GDP and its economic impact. The growth-stimulating effect is often seen as limited compared to that of other government spending, and its amount is a drain on spending that could be more useful and effective. The impact on research and development is also controversial. Claude Serfati dealt particularly with this issue. He states in particular about France: “The determination to justify defence spending on the basis of its usefulness for the productive system goes against all contemporary reality.”6 That said, when it is necessary for them to “hold their rank” in inter-imperialist competition, politicians and capitalists are never short of justifications to defend military budgets and, like Emmanuel Macron, denounce the “crazy money” put into social policies. These are subject to multiple assessments and controls and those who benefit from them are constantly suspected of cheating while military markets escape this vigilance although exports are a major focus of embezzlement of public money and corruption.

- In any case, in the case of France, if the production and export of arms constitute one of the few industrial strengths (France is the third largest exporter in the world), military spending has in no way prevented the overall decline of the industrial apparatus and generates imports (components of various kinds and so on).

9. At first sight, one point is currently positive: the employment situation with an increase in the number of jobs and a fall in unemployment, which seems difficult to explain in a context of limited growth.

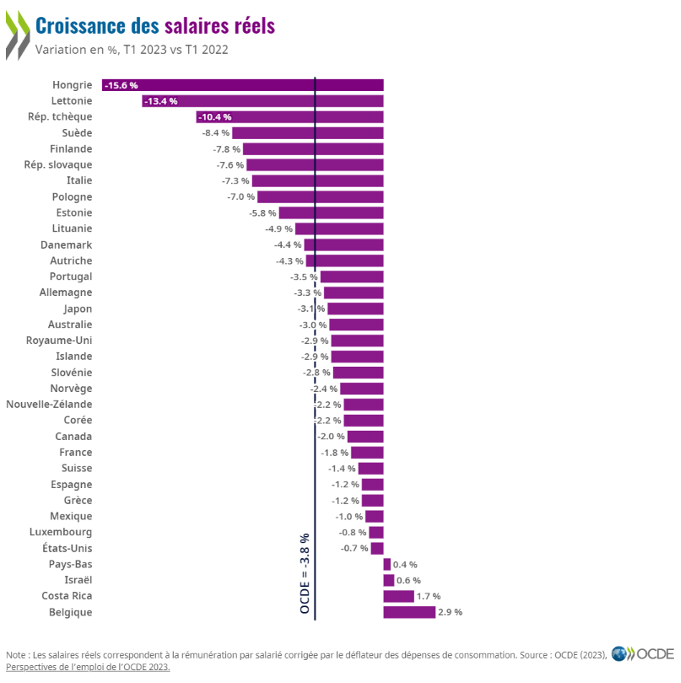

An article by Romaric Godin in Mediapart shows that we can see this distortion between employment and production in several “Western” countries.7 A little less strong in the United States, it is very noticeable in the United Kingdom or Germany, for example. One of the reasons for this is pressure on wages: real wages (taking inflation into account) have fallen in the vast majority of OECD countries: from the 1st quarter of 2022 to the 1st quarter of 2023, the average decline is 3.8%.

In France, the massive aid distributed to companies may have helped some companies to maintain a level of employment above their immediate needs (waiting, for example, for supply disruptions to stop) but also to keep other companies alive even though they should have gone bankrupt. In addition, a specific driver is added to all recruitment subsidies, to support recruitment: apprenticeship supported by benefits (for employers) considerably increased since 2018. These contracts account for one third of job creation. The number of apprentices increased from 437,000 at the end of 2018 to 980,000 at the end of 2022. However, employment is slowing: according to INSEE, the unemployment rate would remain stable at 7.1% of the active population until the end of 2023.

In any case, the overall figures on job creation obviously say nothing about the quality of these jobs (salary, type of contract, working hours). The goal of full employment to which Macron refers from time to time is at best full statistical employment (with an unemployment rate close to 5%) based both on an increase in pressure on the unemployed and on precarious and low-wage status on a significant part of those who will be employed. This relates to Marx's analyses of the industrial reserve army: in Capital three categories in this “reserve” are thus distinguished, one of which is characterized by going back and forth between employment and unemployment as well as by low wages: “The third category of relative overpopulation, stagnant, belongs to the active industrial army, but at the same time the extreme irregularity of its occupations makes it an inexhaustible reservoir of forces. Available. Accustomed to chronic misery, to conditions of existence which are quite precarious and shamefully below the normal level of the working class, it becomes the broad base of special branches of exploitation...”8

10. Profits. It is difficult to understand the reality of profit rates from national accounts data and information from enterprises. For the time being, and despite the absence of company closures (which allow the rate of profit to be raised by eliminating the least profitable), according to the managers of the big companies, profits are doing rather well.

Profits rose sharply in 2020 and for now seem to be holding up despite rising costs. Thus, at the end of July 2022, Carlos Tavares (CEO of Stellantis) proudly displayed his confidence: if new major shocks, such as a global economic recession or an energy supply crisis in Europe, are not scenarios to be excluded, Stellantis would be able to face them: “In the first half of the year, our break-even point fell to 40% of sales…. We could take a 60% drop in sales, we would still be profitable”.

More recently in France, despite the slowdown in activity and the rise in interest rates, the margin rate has also increased. It reached 32.3% of value added between January and March 2023, compared to 31.9% in the third and fourth quarters of 2022.

Two factors played a role in this. Profits were initially boosted by government measures, whether it was the new reduction in production taxes with the abolition of half of the contribution on the added value of companies (CVAE) or the aid deployed to cushion the shock of soaring gas and electricity prices for companies. Secondly, and this is a general observation of INSEE, the Autorité de la concurrence pour la France and the OECD as well as the IMF at the international level, companies have done more than pass on cost increases (wages and intermediate goods) and have therefore increased their profits and contributed to inflation. A paper by IMF economists estimates that 45% of inflation is attributable to profits in the Eurozone between early 2022 and early 2023. One term is currently all the rage in Britain and the United States: greedflation.9

Recent work by INSEE highlights the substantial profits made by the agri-food industry, whose gross operating surplus peaked at 7 billion euros in the first quarter, 18% more than in the previous three months. In the process, the sector's margin rate was propelled to 48%.

There is indeed currently a “price-profit loop” and not a “price-wage” loop, but two caveats must be highlighted in relation to greedflation:

- The heterogeneity of the situations of companies that have more or less possibilities to raise their prices according to their size and their place in the production and distribution chains;

- The fact that the “greed” denounced is a permanent characteristic of capitalism, all the sharper as the balance of forces (i.e., the monopolization of the economy and the capital-labour relationship) allows.

All in all, despite the possible impact of military spending and the billions poured by states to support companies (see below the development on “capitalism on drip”), all the ingredients for a sharp slowdown in the world economy currently seem to be present.

The “Long Depression”

Ernest Mandel provided an analysis and interpretation of the “long waves” of capitalism. 10These multi-decade movements of the economy alternate expansive and recessive phases to which short cycles are superimposed. Recent developments in capitalism may raise questions about the continued relevance of this scheme for the years after the great reversal of capitalism in the 1970s (in the wake of what has been described as the “oil shock”). Without pretending here to settle this complex question, it is possible to resort to a slightly different reading grid, that of the English Marxist economist Michael Roberts.

It distinguishes:

- Cyclical recessions followed by periods of expansion;

- Great depressions, which are sustained periods of low average growth where recoveries remain weak and limited. There would be food for thought on the articulation between these depressions and the succession of long waves described by Mandel.

For Roberts, the current phase corresponds to the 3rd Great Depression in the history of capitalism. It would have started in 2007-2008 with the financial crash and then the global recession. The period of low growth was then marked by the coronavirus crisis and the war in Ukraine.

In its forecasts of last June, the OECD also stresses that growth in industrialized countries will remain weak for structural reasons that add to the various uncertainties:

- Declining labour productivity.

- Investment in productive capital in the economies of its member countries has been much lower since 2010 than it has been in previous decades. The case of Japan is significant: in the 1980s, the growth of productive capital exceeded 5% per year. Since 2010, it has been almost zero. For the Euro area, the figures fell from almost 3% to less than 1% respectively.

There is a gap between the prevailing discourse, the observations that many of us can make and, on the other hand, macroeconomic data: new information technologies (ICTs) persist in not generating an acceleration in productivity gains. INSEE, for its part, found the differential effects of computerization according to the sectors but also noted “the gradual slowdown in productivity gains at the level of the entire economy, as can be observed in France or in most developed countries”11.

The expansion of the share of services in GDP provides an element of explanation and also the fact that some activities rely more on low-wage and fragmented employment than on technology. But, overall, this situation remains poorly explained.

The pandemic: capitalism on a drip

When the pandemic broke out, capitalism – at least in OECD countries – continued to bear the consequences of the 2008-2009 crisis: the so-called “subprime” crisis.

In general, capitalism has been put on a drip. On 12 March 2020, Emmanuel Macron announced that the government would face the coronavirus “whatever the cost”. Without necessarily proclaiming it so emphatically, individual states have increased their spending well beyond the previously stated budgetary targets. In addition to the “laxity” of central banks that had persisted since the 2008-2009 crisis, massive budgetary support for companies (and, to a much lesser extent, aid to the unemployed) was added.

As a result of these policies, the deep recession was not accompanied by capital destruction: there were no major bankruptcies during the Covid crisis (an exception: department store chains in the United States). If we go back, this is not a totally new phenomenon.

In fact, for banks and very large corporations, bankruptcies seem less and less a reality in today's capitalism. The big banks are rescued by the states for fear of the potential risks that their fall would entail (in application of the “too big to fail” rule). As for the large industrial and transport companies, they are restructuring, eliminating jobs, closing establishments and shifting their difficulties to subcontractors.

Another consequence of this support is that there has been no destruction of fictitious capital. On the contrary, thanks to massive purchases of securities by central banks, financial markets quickly continued to thrive and billionaires to get richer (globally, their wealth increased by $1.9 trillion in 2020).

In the Eurozone, rules limiting budget deficits and state aid have been temporarily suspended. The ECB has increased its interventions. In addition, an important innovation was created in July 2020 - a European recovery fund (called Next Generation EU) financed by a loan issued by the European Union. Some, including on the left, wanted to see these measures as the announcement of a fundamental and “progressive” turn of the EU that would have begun to free itself from the budgetary rules resulting from the Maastricht Treaty and the agreements that followed it. More lucid and realistically, the aforementioned American economist Adam Tooze pointed out that the fiscal and other measures taken in 2020 in the United States, the European Union and elsewhere had a “fundamental conservative logic”. It is indeed a question of saving the system and its actors (banks, large companies). For this, even the most neoliberals are ready to spend, even if it means returning to austerity later.

After covid, Ukraine

After the peak of the pandemic, the optimism that oozed from the speeches of leaders, eager to oblivion the pandemic and its consequences, was quickly tarnished.

First, an analysis prevailed according to which the problems were mainly explained by the sudden reactivation of the economy after health restrictions and lockdowns. This analysis drew a line under the structural causes. Thus, shortages (raw materials, electronic components, spare parts) refer to characteristics of the neoliberal model (break-up of productive processes, just-in-time, zero stock).

The aggression against Ukraine and its consequences have increased economic tensions:

- First, inflationary pressures: oil, gas, grains and so on. In the aftermath, consumer prices, which were already rising, began to rocket. The rise in inflation has prompted a flood of commentary and analysis. The dominant economists blame the price-wage loop: for them, the risk is that the rise in prices awakens the “sleeping monster” (wage demands). But in fact, what is at issue today is (as developed above) a profit-wage loop.

- Second, recessionary trends: since the beginning of 2022, the IMF has been revising its growth forecasts downwards.

Economic policy dilemmas and constraints

To fight inflation, the government and central banks use the weapon of interest rates which reinforces recessionary tendencies. Faced with inflationary pressures, even before the invasion of Ukraine, central banks had decided to move away from “easy money” policies and raise interest rates to calm inflation. For now, they are sticking to that direction. But this can only deepen depressive tendencies and increase the difficulties of the countries of the South.

Public debt strengthens the supervision of rating agencies. A country's rating influences the cost at which it can finance its debt in financial markets. Rating agencies are private companies (three major companies exist in the world) whose role is to provide information on the creditworthiness of a debt issuer, i.e., its ability (or willingness) to repay its loans. The more investors consider that they are taking a significant risk, the higher the remuneration (interest rate) they charge. Hence the desire, especially in the euro zone, to squeeze budgetary spending to control deficits since the neoliberal canons prohibit tax increases.

The weakness of productivity gains means that in order to maintain the rate of profit, wages must be squeezed (or prices raised by those firms that can) which weighs on demand.

There is an awareness among some governments and in certain economic circles that finance should be reregulated to avoid further major shocks. But the instruments put in place (Basel 1, 2, 3) are insufficient or circumvented by financial actors. To tackle this would be to call into question the entire current edifice characterized by the hypertrophy of finance capital and its hold on governments and state apparatuses.

As for the ecological crisis, if consciousness becomes widespread as best it can (with delays in relation to its acceleration), the states in symbiosis with big capital prove incapable of facing it because it would mean at least incursions into the logic of profit. It is therefore above all, rather than fighting against global warming, about “living with it” by finding additional opportunities for profit and investment.

Another world?

The “Great Depression” is accompanied by large-scale structural changes in capitalism that will be unevenly explained here.

- A new phase of globalization. This is not a de-globalization but a redeployment of international trade and value chains. World trade, which before 2010 was growing twice as fast as GDP, is decelerating. There are several explanations: rising transport costs, rising wages in China, the acceleration of the robotization of assembly lines or problems with delivery times, quality or safety of relocated products. The effects are differentiated according to the sectors. There are also political factors that either encourage industrialists to relocate certain activities in a territory or lead to globalization between countries deemed “safe.” “Alongside relocations, there will be a movement towards globalization among friends, in which strategically key goods are produced at home or by allied countries,” the World Trade Organization (WTO) wrote in a paper on the consequences of the war in Ukraine.

- A capitalism that combines, to the delight of companies and their shareholders, neoliberalism and public credit. To be convinced, you only have to count the billions of dollars poured into the United States, China and the European Union to support the development of microprocessor or battery factories for vehicles.

- A shift in the world that is first reflected in the rise of Chinese power: economic, military and political. There are many signs of this, and not only economic: in the field of international politics, China has recently promoted a rapprochement between Iran and Saudi Arabia and convened a conference of the ex-Soviet states of Central Asia without the participation of Russia. But in some sectors, China is lagging behind: despite excessive efforts, it does not yet produce the most advanced microprocessors.

- The United States has scored an important point in reinvigorating NATO. In addition, Biden wants to strengthen the US economy in new technologies and against China. He pushed through several major programs in Congress despite difficulties with the Republicans (who mostly block the social aspects of these programs). First, a program of major works to rehabilitate infrastructure: bridges, highways, pipes, internet networks... representing $550 billion in new federal spending. Then the “Inflation Reduction Act,” a $430 billion program to accelerate the energy transition with “Made in America” products. Finally, the “CHIPS Act” (280 billion over ten years), which should boost the installation of advanced technological plants in the United States. These programs are causing concern in Europe because they favour American companies or European companies that set up in the United States. In addition, the US does not simply want to develop its production capacities but also to influence the development of those of China: it succeeded in March 2023 in forcing the Dutch firm ASML, producer of machines to manufacture the most efficient “chips”, to limit its sales to China.

- Europe is disadvantaged by the context of militarization of the world, is trying to cope with it but is caught between the United States and Russia (which obviously remains a military power despite its difficulties in Ukraine). In the European Union, the different member states compete for investment: Tesla, battery and microprocessor factories and so on.

- Finally, even if it will not be developed here, the pervasiveness of the ecological crisis which refers to a limit that capitalism will increasingly come up against even in the countries at the heart of the system. Until now, they (especially because of their more or less temperate climate) could think that global warming and its impact mainly concerned Pacific islands, Bangladesh, the Sahel, etc. This is no longer the case... Even if, as has been seen above, the dominant elites are not ready to really face it.

In conclusion, we must return to the term “polycrisis,” there are indeed various crises that interlock and combine their ravages but, behind them, a decisive underlying foundation: the impasses of capitalism, a system whose contradictions sharpen but can only lead to a non-regressive alternative through the action of “those below.”

Techno-optimists and techno-pessimists

The emergence of information and communication technologies (ICT) and the consequent changes in the productive apparatus are reminiscent of past industrial revolutions (mechanization of production or appearance of electricity). However, the expected productivity gains have been slow to be felt: as early as the late 1980s, Nobel laureate Robert Solow was surprised by the paradox that "computers [are] present everywhere except in productivity statistics" (Solow, 1987). Moreover, in view of the slowdown in productivity gains over the recent period, particularly in non-ICT-producing sectors, future ICT productivity gains are debated, pitting techno-pessimistic and techno-optimistic against each other. For the former, productivity gains would already be exhausted to the extent that the efficiency generated by the use of ICT may diminish as the production apparatus is more equipped with it (e.g., Gordon, 2015). For others, the effects of this technological revolution are yet to come and an acceleration in productivity could manifest itself with the gradual reduction of transition costs, as at the time of the diffusion of electricity (e.g., Brynjolfsson, Rock, and Syverson, 2017).

- 1Adam Tooze, Chartbook #130 Defining polycrisis - from crisis pictures to the crisis matrix (substack.com).

- 2Oxfam-SBF-_dividendes_DEF.pdf report (oxfamfrance.org).

- 3On the problem of measuring inflation, see Inflation: the class struggle through prices, Institut la Boétie.

- 4Claude Serfati, La mondialisation armée, Textuel, 2001.

- 5Ernest Mandel, "Europe: Recovery and Austerity", August 1992.

- 6Claude Serfati: "The determination to justify defence spending on the basis of its usefulness for the productive system goes against all contemporary reality", osintpol.

- 7“The high cost of rising employment,” Mediapart.

- 8Karl Marx, Capital, Book I, XXV.IV.

- 9Robert Reich, June 1, 2023, "It's greedflation, stupid," substack.com.

- 10Ernest Mandel, The Long Waves of Capitalist Development. A Marxist interpretation, Syllepse 2014.]

- 11INSEE, 2018, "Computerization, productivity and employment: differentiated effects between industrial sectors according to technological level", INSEE Analyses 41.